Chapter 1: What Are Black Swan Events?

Definition and concept of black swan events

A black swan event is a term used to describe an event that is beyond what is normally expected of a situation and has potentially severe consequences. Black swan events are characterized by their extreme rarity, severe impact, and the widespread insistence they were obvious in hindsight.

The term “black swan” was first used by philosopher and mathematician Nassim Nicholas Taleb in his book The Black Swan: The Impact of the Highly Improbable. Taleb used the term to describe events that are so unexpected that they fall outside the realm of normal expectations. He argued that black swan events are often ignored or downplayed by experts, who are often blinded by their own biases and assumptions.

Black swan events can have a significant impact on the stock market. For example, the 9/11 terrorist attacks, the 2008 financial crisis, and the COVID-19 pandemic all caused major stock market crashes. These events were all unexpected and had a profound impact on the global economy.

As an investor, it is important to be aware of the potential for black swan events. While it is impossible to predict when or where these events will occur, you can take steps to protect your investments. Some tips for dealing with black swan events include:

- Diversify your portfolio. This will help to reduce your risk if one stock or sector of the market takes a major hit.

- Have a long-term investment horizon. This will help you to ride out the volatility caused by black swan events.

- Stay informed about current events. This will help you to identify potential black swan events and to take steps to protect your investments.

Black swan events are a fact of life. By understanding the risks and having a plan in place, you can help to protect your investments from the devastating impact of these events.

Here are some additional details about black swan events:

- They are rare. Black swan events are so rare that they are often dismissed as impossible or unlikely. However, they do occur, and when they do, they can have a major impact.

- They have a major impact. Black swan events can cause widespread economic and social disruption. The 9/11 terrorist attacks, the 2008 financial crisis, and the COVID-19 pandemic are all examples of black swan events that had a major impact on the world.

- They are often unpredictable. Black swan events are often unpredictable. This is because they are caused by factors that are outside of our control, such as natural disasters, wars, and terrorist attacks.

- They are often rationalized after the fact. Once a black swan event has occurred, people often try to rationalize it by saying that it was inevitable or that they should have seen it coming. However, this is usually not the case. Black swan events are truly unpredictable.

By understanding the concept of black swan events, investors can better prepare for and protect themselves from these unexpected events.

Role of unpredictability in financial markets

Unpredictability is a major factor in financial markets. Prices of stocks, bonds, and other financial instruments are constantly fluctuating, and it is impossible to predict with certainty what they will do in the future. This unpredictability can make it difficult for investors to make informed decisions about where to put their money.

There are a number of factors that contribute to the unpredictability of financial markets. These include:

- Economic factors: Economic conditions can have a major impact on financial markets. For example, a recession can lead to a decline in stock prices, while a strong economy can lead to an increase in stock prices.

- Political factors: Political events can also have a major impact on financial markets. For example, the election of a new president or the outbreak of a war can lead to volatility in the markets.

- Technological factors: Technological advancements can also lead to volatility in financial markets. For example, the development of new financial instruments or the introduction of new trading platforms can lead to changes in the way that markets operate.

The unpredictability of financial markets can make it difficult for investors to make money. However, it can also create opportunities for investors who are willing to take on risk. By understanding the factors that contribute to unpredictability, investors can better position themselves to take advantage of market opportunities.

Here are some tips for dealing with the unpredictability of financial markets:

- Diversify your portfolio. This will help to reduce your risk if one investment loses value.

- Have a long-term investment horizon. This will help you to ride out short-term market volatility.

- Stay informed about current events. This will help you to identify potential risks and make informed investment decisions.

- Don’t panic. It is important to stay calm and make rational decisions during times of market volatility.

By following these tips, you can help to protect your investments from the unpredictability of financial markets.

Introduction to the impact of black swan events on investments

A black swan event is a term used to describe an event that is beyond what is normally expected of a situation and has potentially severe consequences. Black swan events are characterized by their extreme rarity, severe impact, and the widespread insistence they were obvious in hindsight.

The term “black swan” was first used by philosopher and mathematician Nassim Nicholas Taleb in his book The Black Swan: The Impact of the Highly Improbable. Taleb used the term to describe events that are so unexpected that they fall outside the realm of normal expectations. He argued that black swan events are often ignored or downplayed by experts, who are often blinded by their own biases and assumptions.

Black swan events can have a significant impact on the stock market. For example, the 9/11 terrorist attacks, the 2008 financial crisis, and the COVID-19 pandemic all caused major stock market crashes. These events were all unexpected and had a profound impact on the global economy.

As an investor, it is important to be aware of the potential for black swan events. While it is impossible to predict when or where these events will occur, you can take steps to protect your investments. Some tips for dealing with black swan events include:

- Diversify your portfolio. This will help to reduce your risk if one stock or sector of the market takes a major hit.

- Have a long-term investment horizon. This will help you to ride out the volatility caused by black swan events.

- Stay informed about current events. This will help you to identify potential black swan events and to take steps to protect your investments.

Black swan events are a fact of life. By understanding the risks and having a plan in place, you can help to protect your investments from the devastating impact of these events.

Here are some examples of black swan events that have had a significant impact on the stock market:

- The 9/11 terrorist attacks: The 9/11 terrorist attacks caused a major stock market crash on September 11, 2001. The Dow Jones Industrial Average (DJIA) fell by over 600 points, or 7.1%, on the day of the attacks. The market took several months to recover from this event.

- The 2008 financial crisis: The 2008 financial crisis was caused by a number of factors, including the collapse of the subprime mortgage market. The crisis led to a major stock market crash, with the DJIA falling by over 50% from its peak in October 2007 to its low in March 2009. The market took several years to recover from this event.

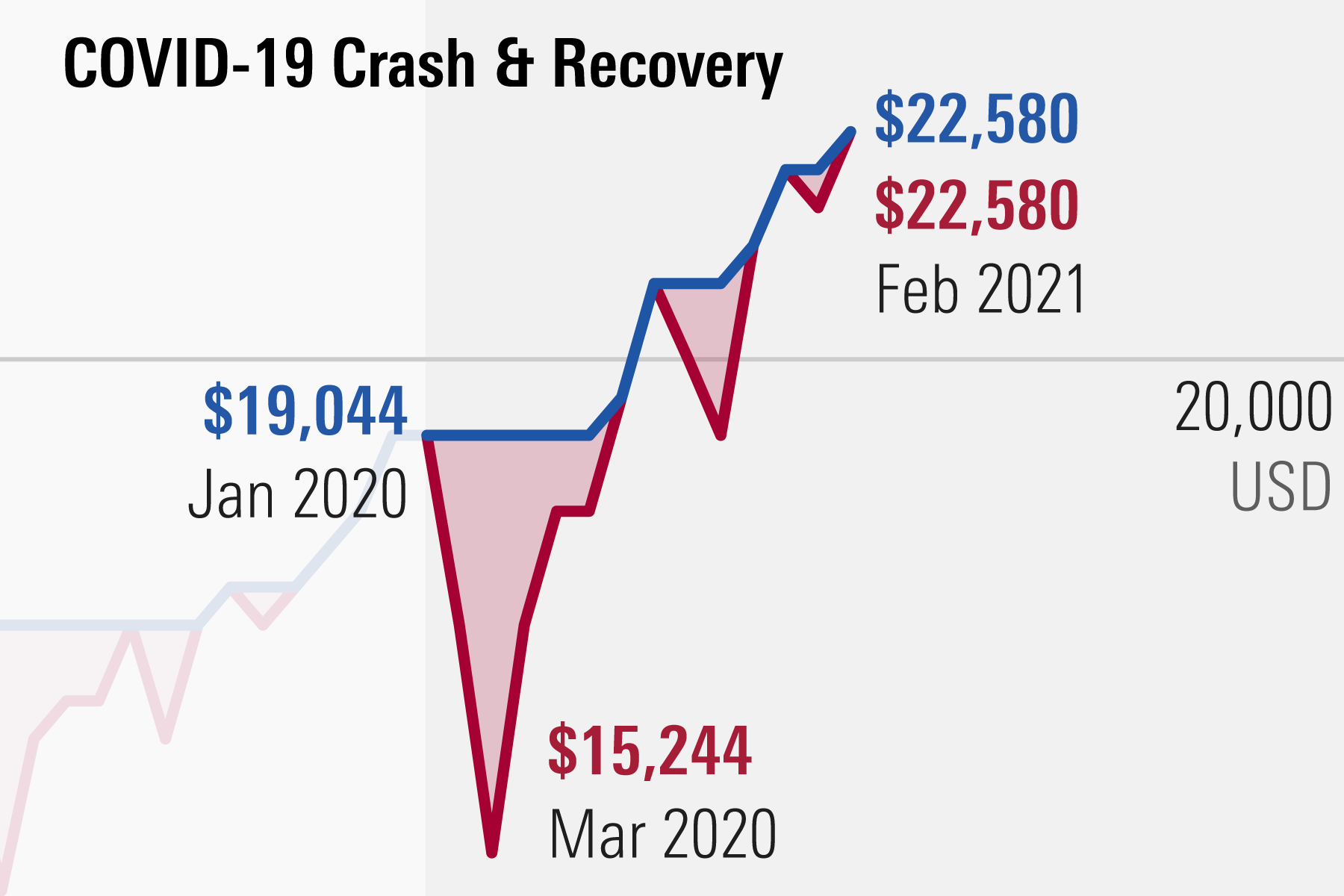

- The COVID-19 pandemic: The COVID-19 pandemic caused a major stock market crash in March 2020. The DJIA fell by over 30% in just one week. The market has since recovered, but it is still unclear what the long-term impact of the pandemic will be on the stock market.

These are just a few examples of black swan events that have had a significant impact on the stock market. By understanding the risks associated with black swan events, investors can better protect their investments from these unexpected events.

Historical examples of black swan events in the stock market

Sure, here are some historical examples of black swan events in the stock market:

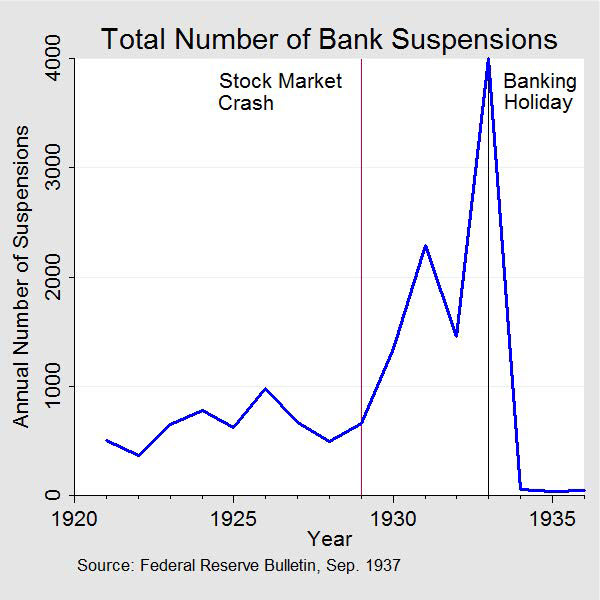

- The 1929 Stock Market Crash: This was the most famous black swan event in stock market history. The crash was caused by a number of factors, including over-speculation and a lack of regulation. The crash wiped out millions of investors and led to the Great Depression.

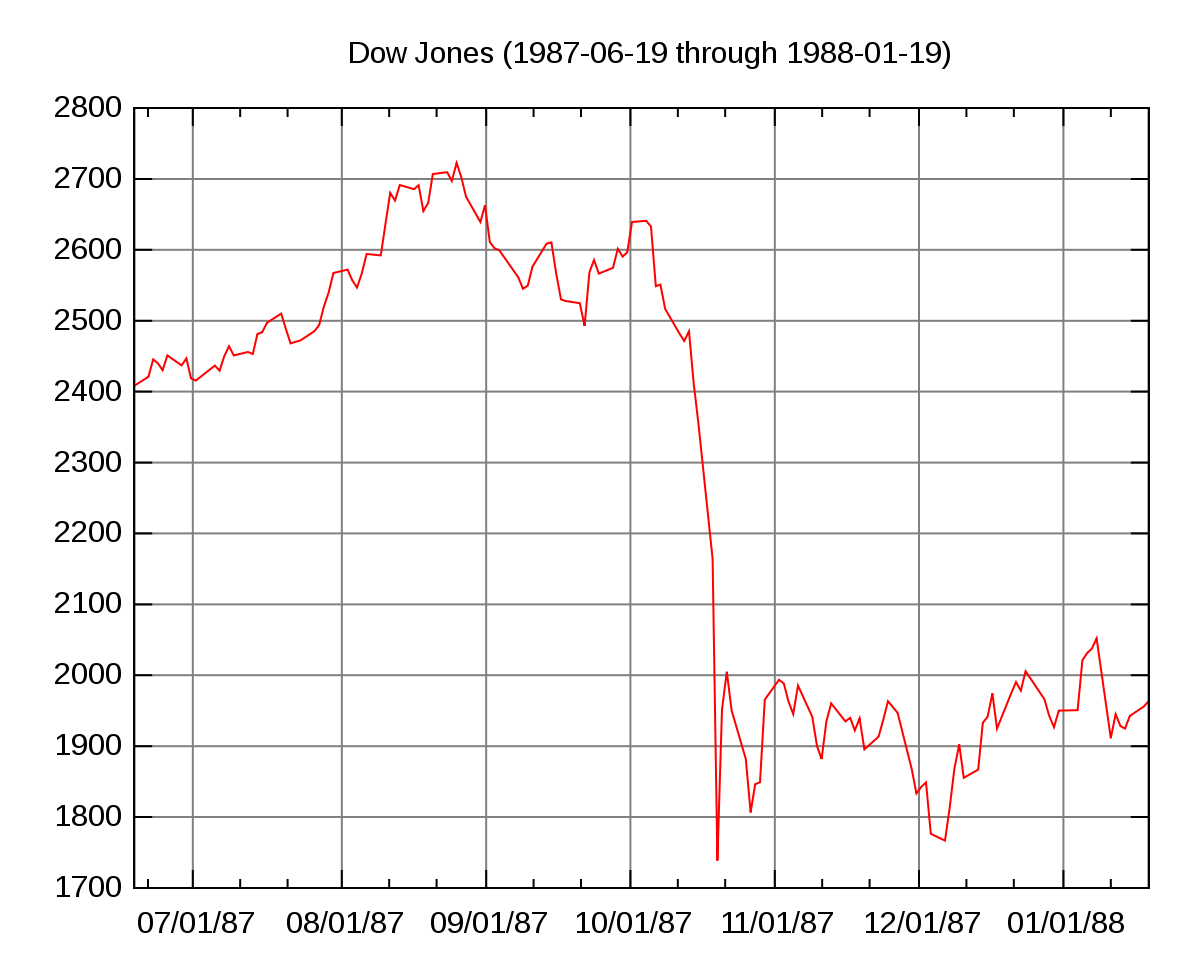

- The 1987 Stock Market Crash: This crash was caused by a number of factors, including computer-driven trading and a lack of liquidity. The crash wiped out billions of dollars in value and led to a bear market.

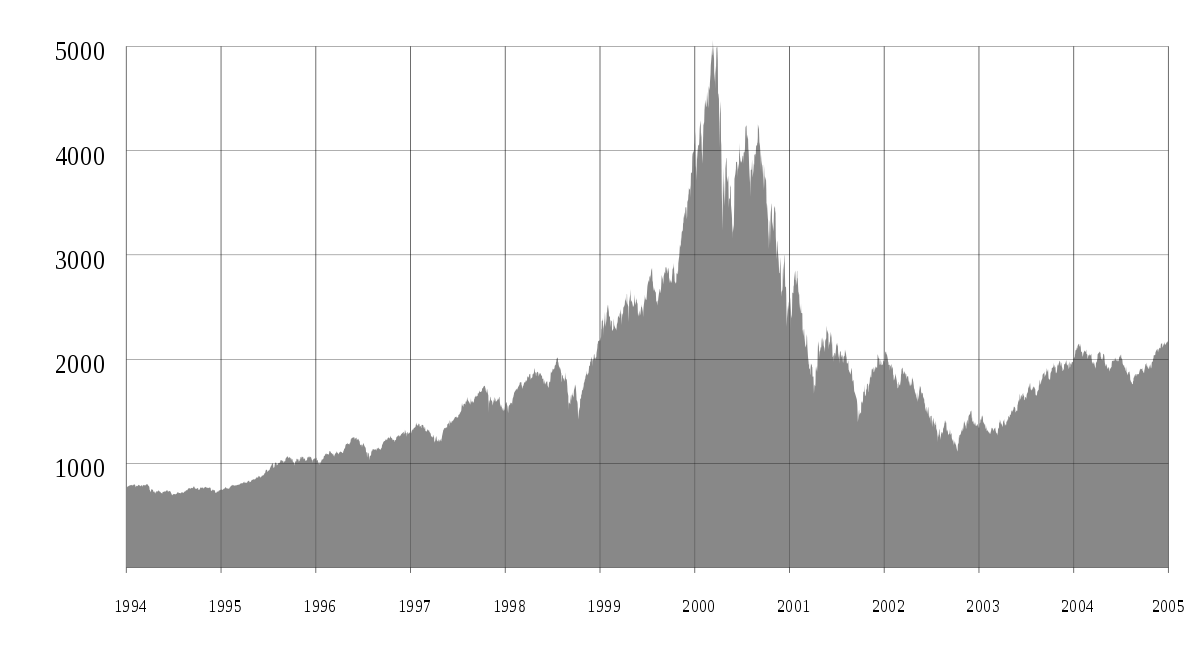

- The Dot-Com Bubble: This bubble was caused by a surge in investment in technology stocks. The bubble burst in 2000, leading to a decline in stock prices and the loss of millions of jobs.

- The 2008 Financial Crisis: This crisis was caused by a number of factors, including subprime lending, mortgage-backed securities, and a lack of regulation. The crisis led to a recession and the collapse of several major financial institutions.

:max_bytes(150000):strip_icc()/2008-financial-crisis-3305679-final-JS-03a006d464d7465aaf331145a1252beb.png)

- The COVID-19 Pandemic: This pandemic has had a significant impact on the global economy, including the stock market. The pandemic has led to a decline in economic activity and a rise in unemployment. As a result, stock prices have declined.

These are just a few examples of black swan events that have had a significant impact on the stock market. Black swan events are unpredictable and can have a major impact on the economy and the stock market. However, by understanding the risks and being prepared, investors can reduce their losses and protect their investments.

Understanding the characteristics of black swan events

Sure, here are some of the characteristics of black swan events:

- They are unpredictable. Black swan events are by definition unexpected. They cannot be predicted by traditional risk models.

- They have a major impact. Black swan events can have a significant impact on the economy, the stock market, and other aspects of society.

- They are often caused by unforeseen events. Black swan events are often caused by events that were not considered possible or likely.

- They are often rationalized in hindsight. Once a black swan event has occurred, people often try to explain it away by saying that it was “obvious” or “inevitable.”

It is important to understand the characteristics of black swan events so that you can be prepared for them. By understanding the risks, you can reduce your losses and protect your investments.

Here are some tips for dealing with black swan events:

- Diversify your portfolio. This means investing in a variety of different assets, such as stocks, bonds, and cash. By diversifying your portfolio, you can reduce your risk if one asset class declines in value.

- Have a long-term investment horizon. Don’t panic and sell your investments if the stock market crashes. Instead, stay calm and focus on the long term. The stock market has always recovered from crashes in the past, and it will likely do so again in the future.

- Rebalance your portfolio regularly. This means selling some of your winners and buying more of your losers. By rebalancing your portfolio, you can keep your investments in line with your risk tolerance and investment goals.

By following these tips, you can reduce your risk and protect your investments in the event of a black swan event.

Here are some additional tips for investors:

- Stay informed. Read financial news and analysis to stay up-to-date on the latest economic and market conditions.

- Have a plan. Before you invest, decide how much risk you are willing to take and what your investment goals are.

- Don’t panic. It is natural to feel anxious during a market crash, but it is important to stay calm and make decisions based on your long-term goals.

Investing can be a risky proposition, but it can also be a rewarding one. By following these tips, you can reduce your risk and increase your chances of success.

Common misconceptions about black swan events

There are a few common misconceptions about black swan events.

- They are always negative. Black swan events can be either positive or negative. For example, the invention of the internet was a black swan event that had a positive impact on the world.

- They are impossible to predict. While black swan events are unpredictable, they are not impossible to predict. By understanding the potential for black swan events and by being prepared, investors can reduce their losses and protect their investments.

- They are always caused by unforeseen events. Black swan events can be caused by both unforeseen events and by events that were considered possible but unlikely. For example, the 9/11 terrorist attacks were a black swan event that was caused by an unforeseen event. However, the 2008 financial crisis was a black swan event that was caused by events that were considered possible but unlikely, such as the collapse of the subprime mortgage market.

It is important to understand the common misconceptions about black swan events so that you can make informed decisions about your investments. By understanding the risks, you can reduce your losses and protect your investments.

Here are some additional tips for investors:

- Stay informed. Read financial news and analysis to stay up-to-date on the latest economic and market conditions.

- Have a plan. Before you invest, decide how much risk you are willing to take and what your investment goals are.

- Don’t panic. It is natural to feel anxious during a market crash, but it is important to stay calm and make decisions based on your long-term goals.

Investing can be a risky proposition, but it can also be a rewarding one. By following these tips, you can reduce your risk and increase your chances of success.

Theories and models for analyzing black swan events

There are a number of theories and models for analyzing black swan events.

- Nassim Nicholas Taleb’s black swan theory: Taleb’s theory of black swan events is a metaphor for an event that comes as a surprise, has a major effect, and is often inappropriately rationalized after the fact with the benefit of hindsight. Taleb argues that black swan events are inevitable and that we should learn to live with them.

- The fat tail model: The fat tail model is a statistical model that assumes that the probability of extreme events is not negligible. The fat tail model is often used to model financial markets, where black swan events are common.

- The chaos theory: The chaos theory is a branch of mathematics that studies systems that are sensitive to initial conditions. The chaos theory suggests that small changes in initial conditions can lead to large changes in the system’s behavior. This suggests that black swan events may be caused by small changes in the system that are difficult to predict.

These are just a few of the theories and models for analyzing black swan events. There is no single theory or model that is perfect, but by understanding these theories and models, we can better understand black swan events and how to mitigate their impact.

Here are some additional tips for investors:

- Stay informed. Read financial news and analysis to stay up-to-date on the latest economic and market conditions.

- Have a plan. Before you invest, decide how much risk you are willing to take and what your investment goals are.

- Don’t panic. It is natural to feel anxious during a market crash, but it is important to stay calm and make decisions based on your long-term goals.

Investing can be a risky proposition, but it can also be a rewarding one. By following these tips, you can reduce your risk and increase your chances of success.

Quantifying the impact of black swan events on investments

Black swan events are unpredictable and can have a major impact on investments. However, by understanding the potential for black swan events and by being prepared, investors can reduce their losses and protect their investments.

One way to quantify the impact of black swan events on investments is to use a technique called scenario analysis. Scenario analysis involves creating a hypothetical scenario and then simulating the impact of that scenario on your investments. This can help you to understand how your investments might be affected by a black swan event and to develop strategies for mitigating the impact.

Another way to quantify the impact of black swan events on investments is to use a technique called stress testing. Stress testing involves testing your investments under extreme conditions. This can help you to identify your investments’ weaknesses and to develop strategies for protecting them from black swan events.

By using scenario analysis and stress testing, investors can gain a better understanding of the potential impact of black swan events on their investments. This can help them to make informed decisions about their investments and to protect their wealth from unforeseen events.

Here are some additional tips for investors:

- Stay informed. Read financial news and analysis to stay up-to-date on the latest economic and market conditions.

- Have a plan. Before you invest, decide how much risk you are willing to take and what your investment goals are.

- Don’t panic. It is natural to feel anxious during a market crash, but it is important to stay calm and make decisions based on your long-term goals.

Investing can be a risky proposition, but it can also be a rewarding one. By following these tips, you can reduce your risk and increase your chances of success.

Here are some examples of how black swan events have impacted investments:

- The 9/11 terrorist attacks caused a sharp decline in stock prices. The S&P 500 index lost 14% of its value in the week following the attacks.

- The 2008 financial crisis caused a global recession and a sharp decline in stock prices. The S&P 500 index lost 57% of its value from its peak in October 2007 to its trough in March 2009.

- The COVID-19 pandemic caused a sharp decline in stock prices. The S&P 500 index lost 34% of its value from its peak in February 2020 to its trough in March 2020.

These are just a few examples of how black swan events have impacted investments. Black swan events can have a significant impact on investments, so it is important to be prepared for them.

Strategies for managing and mitigating risks associated with black swan events

Black swan events are unpredictable and can have a major impact on businesses and individuals. However, there are a number of strategies that can be used to manage and mitigate the risks associated with black swan events.

Here are some of the most common strategies:

- Diversify your investments. This means investing in a variety of different assets, such as stocks, bonds, and real estate. By diversifying your investments, you can reduce your risk if one asset class declines in value.

- Have a long-term investment horizon. Don’t panic and sell your investments if the stock market crashes. Instead, stay calm and focus on the long term. The stock market has always recovered from crashes in the past, and it will likely do so again in the future.

- Rebalance your portfolio regularly. This means selling some of your winners and buying more of your losers. By rebalancing your portfolio, you can keep your investments in line with your risk tolerance and investment goals.

- Have an emergency fund. This is a savings account that you can use to cover unexpected expenses, such as a job loss or a medical emergency. Having an emergency fund can help you to weather a black swan event without having to sell your investments at a loss.

- Be prepared to cut back on expenses. If you lose your job or experience another financial setback, you may need to cut back on your expenses. This may mean eating out less, canceling cable TV, or moving into a smaller apartment. Being prepared to cut back on expenses can help you to weather a financial storm.

- Stay informed. Read financial news and analysis to stay up-to-date on the latest economic and market conditions. This can help you to make informed decisions about your investments and to protect your wealth from unforeseen events.

By following these strategies, you can reduce your risk and protect your wealth from black swan events.

Here are some additional tips for investors:

- Don’t panic. It is natural to feel anxious during a market crash, but it is important to stay calm and make decisions based on your long-term goals.

- Don’t try to time the market. Trying to predict when the market will bottom out is a fool’s errand. Instead, focus on investing for the long term and don’t worry about short-term fluctuations in the market.

- Get professional help. If you are not comfortable managing your own investments, consider working with a financial advisor. A financial advisor can help you to create a portfolio that is right for you and to manage your investments through good times and bad.

Case studies on how different industries and sectors have been affected by black swan events

Black swan events are unpredictable and can have a major impact on industries and sectors. Here are some case studies of how different industries and sectors have been affected by black swan events:

- The financial sector: The financial sector has been one of the hardest hit by black swan events. The 2008 financial crisis, the 9/11 terrorist attacks, and the COVID-19 pandemic have all had a significant impact on the financial sector. These events have led to declines in stock prices, job losses, and financial instability.

- The travel and tourism sector: The travel and tourism sector has also been hard hit by black swan events. The COVID-19 pandemic has led to a sharp decline in travel and tourism. This has led to job losses, business closures, and financial hardship for many people in the travel and tourism industry.

- The energy sector: The energy sector has also been affected by black swan events. The 2008 financial crisis led to a decline in demand for energy, which caused prices to fall. The COVID-19 pandemic has also led to a decline in demand for energy, as businesses and individuals have stayed home. This has led to job losses and financial hardship for many people in the energy sector.

- The agriculture sector: The agriculture sector is also vulnerable to black swan events. The 2011 Japanese earthquake and tsunami led to a decline in food production, which caused prices to rise. The COVID-19 pandemic has also led to a decline in food production, as farmers have been unable to get the supplies they need. This has led to job losses and financial hardship for many people in the agriculture sector.

These are just a few examples of how different industries and sectors have been affected by black swan events. Black swan events can have a major impact on businesses and individuals, so it is important to be prepared for them.

Here are some tips for businesses and individuals to prepare for black swan events:

- Have a business continuity plan. A business continuity plan is a document that outlines how a business will continue to operate in the event of a disruption. This plan should include steps to protect data, employees, and customers.

- Have an emergency fund. An emergency fund is a savings account that can be used to cover unexpected expenses, such as a natural disaster or a job loss.

- Be prepared to adapt. Black swan events can be unpredictable, so it is important to be prepared to adapt to change. This may mean changing your business model, your marketing strategy, or your product offerings.

By following these tips, businesses and individuals can reduce their risk and be better prepared for black swan events.

Psychological and behavioral aspects of investor response to black swan events

Black swan events are unpredictable and can have a major impact on the stock market. When these events occur, investors often experience a range of psychological and behavioral responses.

Some common psychological responses to black swan events include:

- Fear: Investors may feel fear and anxiety when the market is volatile. This can lead to them making impulsive decisions, such as selling their investments at a loss.

- Greed: Investors may also experience greed when the market is rising. This can lead them to take on too much risk, which can increase their losses if the market crashes.

- Hope: Investors may also experience hope when the market is falling. This can lead them to believe that the market will recover soon, which can prevent them from selling their investments at a loss.

Some common behavioral responses to black swan events include:

- Herding: Investors may herd, which means they follow the actions of other investors. This can lead to investors making decisions that are not in their best interests.

- Overtrading: Investors may overtrade, which means they buy and sell investments too frequently. This can increase their costs and reduce their returns.

- Underdiversification: Investors may underdiversify, which means they invest in too few assets. This can increase their risk if one asset declines in value.

It is important for investors to be aware of the psychological and behavioral aspects of investor response to black swan events. By understanding these factors, investors can make more informed decisions and reduce their risk.

Here are some tips for investors to help them deal with black swan events:

- Stay calm: It is important to stay calm during a black swan event. This will help you to make rational decisions and avoid making impulsive mistakes.

- Have a plan: Before a black swan event occurs, it is important to have a plan for how you will respond. This plan should include your investment goals, your risk tolerance, and your exit strategy.

- Rebalance your portfolio regularly: Rebalancing your portfolio regularly will help you to keep your investments in line with your risk tolerance and investment goals.

- Don’t panic sell: It is important to avoid panic selling during a black swan event. This is because the market will likely recover in the long run.

- Seek professional help: If you are struggling to deal with a black swan event, it is important to seek professional help. A financial advisor can help you to develop a plan to recover from the event.

Lessons learned from past black swan events and their applications to future investments

Black swan events are unpredictable and can have a major impact on investments. However, there are a number of lessons that can be learned from past black swan events and applied to future investments.

Here are some of the most important lessons:

- Diversify your investments. This means investing in a variety of different assets, such as stocks, bonds, and real estate. By diversifying your investments, you can reduce your risk if one asset class declines in value.

- Have a long-term investment horizon. Don’t panic and sell your investments if the stock market crashes. Instead, stay calm and focus on the long term. The stock market has always recovered from crashes in the past, and it will likely do so again in the future.

- Rebalance your portfolio regularly. This means selling some of your winners and buying more of your losers. By rebalancing your portfolio, you can keep your investments in line with your risk tolerance and investment goals.

- Have an emergency fund. This is a savings account that you can use to cover unexpected expenses, such as a job loss or a medical emergency. Having an emergency fund can help you to weather a black swan event without having to sell your investments at a loss.

- Be prepared to cut back on expenses. If you lose your job or experience another financial setback, you may need to cut back on your expenses. This may mean eating out less, canceling cable TV, or moving into a smaller apartment. Being prepared to cut back on expenses can help you to weather a financial storm.

- Stay informed. Read financial news and analysis to stay up-to-date on the latest economic and market conditions. This can help you to make informed decisions about your investments and to protect your wealth from unforeseen events.

By following these lessons, you can reduce your risk and protect your wealth from black swan events.

Here are some additional tips for investors:

- Don’t panic. It is natural to feel anxious during a market crash, but it is important to stay calm and make decisions based on your long-term goals.

- Don’t try to time the market. Trying to predict when the market will bottom out is a fool’s errand. Instead, focus on investing for the long term and don’t worry about short-term fluctuations in the market.

- Get professional help. If you are not comfortable managing your own investments, consider working with a financial advisor. A financial advisor can help you to create a portfolio that is right for you and to manage your investments through good times and bad.

By following these tips, you can increase your chances of success as an investor.

Regulatory implications and measures to prevent or minimize the impact of black swan events

Black swan events are unpredictable and can have a major impact on businesses and individuals. As a result, regulators have taken steps to prevent or minimize the impact of these events.

Some of the regulatory implications of black swan events include:

- Increased regulation of financial institutions: Regulators have increased regulation of financial institutions in an effort to prevent another financial crisis. This includes measures such as requiring banks to hold more capital and to have plans in place to deal with a crisis.

- Increased oversight of markets: Regulators have also increased oversight of markets in an effort to identify and respond to potential risks. This includes measures such as requiring market participants to report more information and to have systems in place to detect and prevent fraud.

- Increased focus on risk management: Businesses and individuals are also focusing more on risk management in an effort to protect themselves from the impact of black swan events. This includes measures such as diversifying investments, having an emergency fund, and having a plan in place to deal with a crisis.

There are a number of measures that can be taken to prevent or minimize the impact of black swan events. These measures include:

- Improved risk assessment: Regulators and businesses can improve their risk assessment by developing better models for predicting the likelihood and impact of black swan events.

- Increased transparency: Regulators and businesses can increase transparency by sharing information about risks and vulnerabilities. This can help to identify and mitigate risks before they become a crisis.

- Enhanced communication: Regulators and businesses can enhance communication by sharing information about risks and vulnerabilities with the public. This can help to build public trust and resilience in the event of a crisis.

By taking these measures, regulators and businesses can help to prevent or minimize the impact of black swan events.

Here are some additional tips for businesses and individuals to help them prepare for black swan events:

- Have a business continuity plan. A business continuity plan is a document that outlines how a business will continue to operate in the event of a disruption. This plan should include steps to protect data, employees, and customers.

- Have an emergency fund. An emergency fund is a savings account that can be used to cover unexpected expenses, such as a natural disaster or a job loss.

- Be prepared to adapt. Black swan events can be unpredictable, so it is important to be prepared to adapt to change. This may mean changing your business model, your marketing strategy, or your product offerings.

By following these tips, businesses and individuals can reduce their risk and be better prepared for black swan events.

The role of technology and data analytics in identifying and responding to black swan events

Black swan events are unpredictable and have a major impact on businesses and individuals. However, technology and data analytics can play a role in identifying and responding to these events.

Here are some ways that technology and data analytics can be used to identify black swan events:

- Big data: Big data can be used to identify patterns and trends that may indicate a black swan event. For example, big data can be used to track social media activity, economic data, and weather patterns.

- Machine learning: Machine learning can be used to analyze big data and identify potential risks. For example, machine learning can be used to identify patterns in financial data that may indicate a market crash.

- Artificial intelligence: Artificial intelligence can be used to create models that can predict the likelihood of a black swan event. For example, AI can be used to create models that predict the likelihood of a natural disaster.

Once a black swan event has been identified, technology and data analytics can be used to respond to it. For example, technology can be used to:

- Distribute information: Technology can be used to distribute information about a black swan event to businesses and individuals. This information can help people to make informed decisions about how to respond to the event.

- Provide financial assistance: Technology can be used to provide financial assistance to businesses and individuals who have been affected by a black swan event. This assistance can help people to recover from the event.

- Improve communication: Technology can be used to improve communication between businesses, individuals, and government agencies. This communication can help to coordinate the response to a black swan event.

By using technology and data analytics, businesses and individuals can be better prepared for black swan events. These events are unpredictable, but by using technology and data analytics, businesses and individuals can reduce the impact of these events.

Here are some additional tips for businesses and individuals to help them prepare for black swan events:

- Have a business continuity plan. A business continuity plan is a document that outlines how a business will continue to operate in the event of a disruption. This plan should include steps to protect data, employees, and customers.

- Have an emergency fund. An emergency fund is a savings account that can be used to cover unexpected expenses, such as a natural disaster or a job loss.

- Be prepared to adapt. Black swan events can be unpredictable, so it is important to be prepared to adapt to change. This may mean changing your business model, your marketing strategy, or your product offerings.

By following these tips, businesses and individuals can reduce their risk and be better prepared for black swan events.

Evaluating the resilience and adaptability of investment portfolios in the face of black swan events

Black swan events are unpredictable and have a major impact on investments. However, there are a number of ways to evaluate the resilience and adaptability of investment portfolios in the face of these events.

Here are some of the most important factors to consider:

- Diversification: A diversified portfolio is one that is spread across a variety of different asset classes, such as stocks, bonds, and real estate. This helps to reduce risk by limiting exposure to any one asset class.

- Risk tolerance: Investors should consider their own risk tolerance when evaluating the resilience and adaptability of their investment portfolios. Risk tolerance is the amount of risk that an investor is comfortable taking on. Investors with a high risk tolerance may be willing to invest in riskier assets, such as stocks, while investors with a low risk tolerance may prefer to invest in safer assets, such as bonds.

- Investment horizon: The investment horizon is the length of time that an investor plans to hold an investment. Investors with a long investment horizon may be more willing to invest in riskier assets, as they have more time to ride out any short-term fluctuations in the market. Investors with a short investment horizon may prefer to invest in safer assets, as they may need to access their money sooner.

- Rebalancing: Rebalancing is the process of adjusting an investment portfolio to maintain its desired asset allocation. This can help to reduce risk and improve performance.

- Contingency plans: Investors should have contingency plans in place in case of a black swan event. This could include having an emergency fund, having a plan to sell investments, or having a plan to switch to a different investment strategy.

By considering these factors, investors can evaluate the resilience and adaptability of their investment portfolios in the face of black swan events.

Here are some additional tips for investors:

- Don’t panic. It is natural to feel anxious during a black swan event, but it is important to stay calm and make decisions based on your long-term goals.

- Don’t try to time the market. Trying to predict when the market will bottom out is a fool’s errand. Instead, focus on investing for the long term and don’t worry about short-term fluctuations in the market.

- Get professional help. If you are not comfortable managing your own investments, consider working with a financial advisor. A financial advisor can help you to create a portfolio that is right for you and to manage your investments through good times and bad.

By following these tips, investors can increase their chances of success in the face of black swan events.

The future of black swan events in the stock market and potential trends to watch for

Black swan events are unpredictable and can have a major impact on the stock market. However, there are a number of potential trends to watch for in the future that could increase the likelihood of black swan events occurring.

Here are some of the most important trends to watch for:

- Increased globalization: The global economy is becoming increasingly interconnected, which means that events in one part of the world can have a ripple effect on other parts of the world. This increased interconnectedness makes it more likely that black swan events will have a global impact.

- Increased technological innovation: Technological innovation is happening at an increasingly rapid pace, which means that there is a greater potential for new and unforeseen risks to emerge. For example, the development of artificial intelligence could lead to new forms of cyberattacks or financial fraud.

- Increased political instability: The world is becoming increasingly politically unstable, which could lead to more frequent and severe black swan events. For example, a major war or terrorist attack could have a significant impact on the global economy.

By being aware of these trends, investors can better prepare for the possibility of black swan events occurring in the future.

Here are some additional tips for investors:

- Diversify your investments: A diversified portfolio is one that is spread across a variety of different asset classes, such as stocks, bonds, and real estate. This helps to reduce risk by limiting exposure to any one asset class.

- Have a long-term investment horizon: Investors with a long investment horizon may be more willing to invest in riskier assets, as they have more time to ride out any short-term fluctuations in the market. Investors with a short investment horizon may prefer to invest in safer assets, as they may need to access their money sooner.

- Rebalance your portfolio regularly: Rebalancing is the process of adjusting an investment portfolio to maintain its desired asset allocation. This can help to reduce risk and improve performance.

- Have a contingency plan: Investors should have contingency plans in place in case of a black swan event. This could include having an emergency fund, having a plan to sell investments, or having a plan to switch to a different investment strategy.

By following these tips, investors can increase their chances of success in the face of black swan events.

Conclusion: Navigating the uncertainty of black swan events and building resilient investment strategies

Black swan events are unpredictable and can have a major impact on investments. However, by following these tips, investors can increase their chances of success in the face of black swan events:

- Diversify your investments: A diversified portfolio is one that is spread across a variety of different asset classes, such as stocks, bonds, and real estate. This helps to reduce risk by limiting exposure to any one asset class.

- Have a long-term investment horizon: Investors with a long investment horizon may be more willing to invest in riskier assets, as they have more time to ride out any short-term fluctuations in the market. Investors with a short investment horizon may prefer to invest in safer assets, as they may need to access their money sooner.

- Rebalance your portfolio regularly: Rebalancing is the process of adjusting an investment portfolio to maintain its desired asset allocation. This can help to reduce risk and improve performance.

- Have a contingency plan: Investors should have contingency plans in place in case of a black swan event. This could include having an emergency fund, having a plan to sell investments, or having a plan to switch to a different investment strategy.

In addition, investors can also take steps to navigate the uncertainty of black swan events by:

- Staying informed: Investors should stay informed about the latest economic and market conditions. This can help them to make informed decisions about their investments and to protect their wealth from unforeseen events.

- Being prepared to adapt: Black swan events can be unpredictable, so it is important to be prepared to adapt to change. This may mean changing your investment strategy, your asset allocation, or your risk tolerance.

- Seeking professional help: If you are not comfortable managing your own investments, consider working with a financial advisor. A financial advisor can help you to create a portfolio that is right for you and to manage your investments through good times and bad.

By following these tips, investors can increase their chances of success in the face of black swan events.

Here are some additional things to keep in mind:

- Don’t panic: It is natural to feel anxious during a black swan event, but it is important to stay calm and make decisions based on your long-term goals.

- Don’t try to time the market: Trying to predict when the market will bottom out is a fool’s errand. Instead, focus on investing for the long term and don’t worry about short-term fluctuations in the market.

- Be patient: It may take some time for your investments to recover from a black swan event. However, if you stay patient and keep your long-term goals in mind, you will likely see your investments recover and even thrive in the long run.

Chapter 2: The South Sea Bubble (1720)

Historical background and causes of the bubble

The term “bubble” is used to describe a situation where asset prices rise rapidly and far above their fundamental values. Bubbles are often caused by a combination of factors, including:

- Easy access to credit: When it is easy to borrow money, people are more likely to invest in assets, even if those assets are overpriced.

- Speculation: Speculation is when people buy assets not because they believe in the underlying value of the asset, but because they believe that the price of the asset will go up in the future.

- Herd mentality: When people see others making money in an asset, they are more likely to invest in that asset, even if they do not fully understand it.

- Government policies: Government policies can sometimes contribute to the creation of bubbles. For example, low interest rates can make it more attractive to invest in assets, and government guarantees can make people feel more secure about investing in risky assets.

Once a bubble begins, it can often be self-reinforcing. As prices rise, people become more confident that the prices will continue to rise, which leads to even more buying. This can lead to a rapid increase in asset prices, as was seen in the dot-com bubble of the late 1990s and the housing bubble of the early 2000s.

However, bubbles always burst eventually. When a bubble bursts, asset prices fall sharply, and people who invested in the assets lose money. This can lead to financial instability and economic hardship.

The following are some examples of historical bubbles:

- The tulip mania of the 17th century: In the late 1600s, the price of tulip bulbs in the Netherlands rose to extraordinary levels. Some people invested their entire life savings in tulip bulbs, believing that the prices would continue to rise. However, the bubble burst in 1637, and the price of tulip bulbs crashed.

- The South Sea Bubble of the 18th century: In the early 1700s, the South Sea Company was a British company that was granted a monopoly on trade with South America. The company was wildly successful, and its stock price rose to astronomical levels. However, the company’s success was based on fraud, and the bubble burst in 1720.

- The dot-com bubble of the late 1990s: In the late 1990s, there was a rapid rise in the price of stocks of technology companies. The rise was fueled by speculation and a belief that the internet would revolutionize the way businesses operated. However, the bubble burst in 2000, and the price of technology stocks crashed.

- The housing bubble of the early 2000s: In the early 2000s, there was a rapid rise in the price of homes in the United States. The rise was fueled by easy access to credit and a belief that home prices would continue to rise. However, the bubble burst in 2007, and the price of homes crashed.

These are just a few examples of historical bubbles. Bubbles have occurred throughout history, and they will likely continue to occur in the future.

Impact on the stock market and investors

Bubbles can have a significant impact on the stock market and investors. When a bubble bursts, asset prices can fall sharply, and investors can lose a lot of money. This can lead to financial instability and economic hardship.

Here are some of the key impacts of bubbles on the stock market and investors:

- Losses: When a bubble bursts, investors who invested in the assets lose money. The amount of losses can be significant, and it can take years or even decades for investors to recover their losses.

- Financial instability: Bubbles can lead to financial instability. When asset prices fall sharply, it can lead to a decline in economic activity. This can lead to a recession, which can have a negative impact on businesses, jobs, and the overall economy.

- Economic hardship: Bubbles can lead to economic hardship. When asset prices fall sharply, it can lead to job losses, business failures, and a decline in living standards. This can be especially difficult for people who are already struggling financially.

Here are some tips for investors to protect themselves from bubbles:

- Do your research: Before you invest in any asset, it is important to do your research and understand the risks involved.

- Diversify your portfolio: Don’t put all your eggs in one basket. By diversifying your portfolio, you can reduce your risk if one asset class falls in value.

- Have a long-term investment horizon: Don’t try to time the market. Instead, focus on investing for the long term and don’t worry about short-term fluctuations in the market.

- Be patient: It may take some time for your investments to recover from a bubble. However, if you stay patient and keep your long-term goals in mind, you will likely see your investments recover and even thrive in the long run.

By following these tips, investors can protect themselves from the negative impact of bubbles.

Lessons learned from the South Sea Bubble

The South Sea Bubble was a financial crisis that occurred in Great Britain in 1720. The bubble was caused by a number of factors, including:

- Easy access to credit: During this time, it was very easy to borrow money. This made it easier for people to invest in assets, even if those assets were overpriced.

- Speculation: People bought South Sea Company shares not because they believed in the underlying value of the company, but because they believed that the share price would go up in the future.

- Government policies: The British government was heavily involved in the South Sea Company. This gave the company a lot of credibility and made it seem like a safe investment.

The South Sea Bubble eventually burst in 1720. When this happened, the share price of the South Sea Company crashed, and many people lost a lot of money.

Here are some of the lessons that can be learned from the South Sea Bubble:

- Easy access to credit can lead to bubbles: When it is easy to borrow money, people are more likely to invest in assets, even if those assets are overpriced.

- Speculation can lead to bubbles: When people buy assets not because they believe in the underlying value of the asset, but because they believe that the price of the asset will go up in the future, it can lead to a bubble.

- Government policies can contribute to bubbles: Government policies that make it seem like an investment is safe can contribute to a bubble.

By understanding the factors that led to the South Sea Bubble, we can learn how to avoid similar bubbles in the future.

Here are some additional tips to help avoid bubbles:

- Do your research: Before you invest in any asset, it is important to do your research and understand the risks involved.

- Diversify your portfolio: Don’t put all your eggs in one basket. By diversifying your portfolio, you can reduce your risk if one asset class falls in value.

- Have a long-term investment horizon: Don’t try to time the market. Instead, focus on investing for the long term and don’t worry about short-term fluctuations in the market.

- Be patient: It may take some time for your investments to recover from a bubble. However, if you stay patient and keep your long-term goals in mind, you will likely see your investments recover and even thrive in the long run.

By following these tips, you can help protect yourself from the negative impact of bubbles.

Key players and their roles in the South Sea Bubble

There were many key players in the South Sea Bubble, each of whom played a role in its creation and eventual collapse. Some of the most important players included:

- John Blunt: Blunt was the founder and chairman of the South Sea Company. He was a charismatic and persuasive figure who was able to convince many people to invest in the company, even though it was overpriced.

- Robert Walpole: Walpole was the British Prime Minister at the time of the South Sea Bubble. He was a supporter of the company and helped to secure a monopoly for it on trade with South America.

- George I: George I was the King of Great Britain at the time of the South Sea Bubble. He was also a supporter of the company and invested heavily in it.

- The British public: The British public was eager to invest in the South Sea Company because it was seen as a safe and profitable investment. However, many people were misled by the company’s inflated share price and lost a lot of money when the bubble burst.

The South Sea Bubble was a major financial crisis that had a significant impact on the British economy. It led to the collapse of the South Sea Company and the loss of a lot of money by investors. The bubble also led to a number of reforms in the British financial system, which helped to prevent similar crises from happening in the future.

Here are some of the key takeaways from the South Sea Bubble:

- Governments can contribute to bubbles: Government policies that make it seem like an investment is safe can contribute to a bubble.

- Easy access to credit can lead to bubbles: When it is easy to borrow money, people are more likely to invest in assets, even if those assets are overpriced.

- Speculation can lead to bubbles: When people buy assets not because they believe in the underlying value of the asset, but because they believe that the price of the asset will go up in the future, it can lead to a bubble.

By understanding the factors that led to the South Sea Bubble, we can learn how to avoid similar bubbles in the future.

Analysis of the speculative behavior and investor sentiment during the bubble

Speculative behavior and investor sentiment are two of the key factors that contributed to the South Sea Bubble.

Speculative behavior is when people buy assets not because they believe in the underlying value of the asset, but because they believe that the price of the asset will go up in the future. Speculative behavior can lead to bubbles because it can create a self-reinforcing cycle. When people buy assets because they believe that the price will go up, it drives up the price. This, in turn, encourages more people to buy the asset, which drives up the price even further. This cycle can continue until the price of the asset becomes so high that it is no longer sustainable. When this happens, the bubble bursts and the price of the asset crashes.

Investor sentiment is the collective feeling of investors about the market. When investor sentiment is positive, people are more likely to invest in assets, even if those assets are overpriced. This can lead to bubbles because it can create a feedback loop. When people are optimistic about the market, they are more likely to buy assets, which drives up the price. This, in turn, makes people even more optimistic about the market, which encourages them to buy even more assets. This cycle can continue until the price of the asset becomes so high that it is no longer sustainable. When this happens, the bubble bursts and the price of the asset crashes.

In the case of the South Sea Bubble, both speculative behavior and investor sentiment were at play. People were buying South Sea Company shares not because they believed in the company’s underlying value, but because they believed that the share price would go up in the future. This was driven by a number of factors, including:

- Government support: The British government was heavily involved in the South Sea Company. This gave the company a lot of credibility and made it seem like a safe investment.

- Easy access to credit: During this time, it was very easy to borrow money. This made it easier for people to invest in assets, even if those assets were overpriced.

- FOMO: Fear of missing out is a powerful motivator. When people see others making money in an asset, they are more likely to invest in that asset, even if they do not fully understand it.

The combination of speculative behavior and investor sentiment led to the South Sea Bubble. The bubble eventually burst in 1720, when the share price of the South Sea Company crashed. Many people lost a lot of money, and the British economy was plunged into a recession.

The South Sea Bubble is a cautionary tale about the dangers of speculative behavior and investor sentiment. By understanding these factors, we can learn how to avoid similar bubbles in the future.

Comparison of the South Sea Bubble with other historical financial bubbles

The South Sea Bubble was a financial crisis that occurred in Great Britain in 1720. The bubble was caused by a number of factors, including:

- Easy access to credit: During this time, it was very easy to borrow money. This made it easier for people to invest in assets, even if those assets were overpriced.

- Speculation: People bought South Sea Company shares not because they believed in the underlying value of the company, but because they believed that the share price would go up in the future.

- Government policies: The British government was heavily involved in the South Sea Company. This gave the company a lot of credibility and made it seem like a safe investment.

The South Sea Bubble eventually burst in 1720. When this happened, the share price of the South Sea Company crashed, and many people lost a lot of money.

There have been many other historical financial bubbles, and they have all shared some of the same characteristics as the South Sea Bubble. These characteristics include:

- Easy access to credit: When it is easy to borrow money, people are more likely to invest in assets, even if those assets are overpriced.

- Speculation: When people buy assets not because they believe in the underlying value of the asset, but because they believe that the price of the asset will go up in the future, it can lead to bubbles.

- Government policies: Government policies that make it seem like an investment is safe can contribute to a bubble.

Here are some examples of other historical financial bubbles:

- Tulip mania: In the late 1600s, the price of tulip bulbs in the Netherlands rose to extraordinary levels. Some people invested their entire life savings in tulip bulbs, believing that the prices would continue to rise. However, the bubble burst in 1637, and the price of tulip bulbs crashed.

- The Mississippi Bubble: In the early 1700s, John Law, a Scottish economist, founded the Mississippi Company in France. The company was granted a monopoly on trade with the Mississippi River Valley. The company’s stock price rose rapidly, and many people invested in it. However, the company was unable to meet its financial obligations, and the bubble burst in 1720.

- The Railway Mania: In the mid-1800s, there was a rapid increase in the construction of railways in the United Kingdom. This led to a surge in the demand for railway shares, and the price of these shares rose to extraordinary levels. However, the bubble burst in 1847, and the price of railway shares crashed.

- The Dot-Com Bubble: In the late 1990s, there was a rapid increase in the number of internet-related companies. This led to a surge in the demand for shares in these companies, and the price of these shares rose to extraordinary levels. However, the bubble burst in 2000, and the price of dot-com shares crashed.

- The Housing Bubble: In the early 2000s, there was a rapid increase in the price of homes in the United States. This was due to a number of factors, including easy access to credit and a belief that home prices would continue to rise. However, the bubble burst in 2007, and the price of homes crashed.

These are just a few examples of historical financial bubbles. Bubbles have occurred throughout history, and they will likely continue to occur in the future.

By understanding the factors that lead to bubbles, we can learn how to avoid similar bubbles in the future.

Economic and social consequences of the South Sea Bubble

The South Sea Bubble had a significant impact on the British economy and society. The bubble eventually burst in 1720, when the share price of the South Sea Company crashed. Many people lost a lot of money, and the British economy was plunged into a recession.

Here are some of the economic and social consequences of the South Sea Bubble:

- Economic recession: The South Sea Bubble led to a recession in the British economy. This was because many people had invested their savings in the South Sea Company, and when the bubble burst, they lost their money. This led to a decline in spending, which led to a decline in economic activity.

- Increased unemployment: The South Sea Bubble also led to increased unemployment. This was because many businesses that had been financed by the South Sea Company went bankrupt when the bubble burst. This led to job losses, which made it difficult for people to make ends meet.

- Social unrest: The South Sea Bubble also led to social unrest. This was because many people had lost a lot of money, and they were angry and frustrated. This led to protests and riots, which made it difficult for the government to maintain order.

The South Sea Bubble was a major financial crisis that had a significant impact on the British economy and society. The bubble burst led to a recession, increased unemployment, and social unrest. The South Sea Bubble is a cautionary tale about the dangers of speculative behavior and investor sentiment. By understanding the factors that led to the South Sea Bubble, we can learn how to avoid similar bubbles in the future.

Here are some of the lessons that can be learned from the South Sea Bubble:

- Easy access to credit can lead to bubbles: When it is easy to borrow money, people are more likely to invest in assets, even if those assets are overpriced.

- Speculation can lead to bubbles: When people buy assets not because they believe in the underlying value of the asset, but because they believe that the price of the asset will go up in the future, it can lead to a bubble.

- Government policies can contribute to bubbles: Government policies that make it seem like an investment is safe can contribute to a bubble.

By understanding the factors that led to the South Sea Bubble, we can learn how to avoid similar bubbles in the future.

Government response and regulatory changes following the bubble

The government responded to the South Sea Bubble by enacting a number of regulatory changes. These changes were designed to prevent similar bubbles from happening in the future. Some of the key regulatory changes included:

- The Bubble Act of 1720: The Bubble Act prohibited the formation of any new joint-stock companies without a royal charter. This was designed to prevent the formation of companies that were likely to engage in speculative behavior.

- The Bank Act of 1742: The Bank Act limited the amount of money that the Bank of England could lend to the government. This was designed to prevent the government from using easy credit to finance its spending, which could lead to bubbles.

- The Stock Exchange Act of 1801: The Stock Exchange Act established the London Stock Exchange as a regulated market. This was designed to provide investors with more information about the companies they were investing in, which could help to prevent bubbles.

These regulatory changes were successful in preventing similar bubbles from happening in the United Kingdom for a number of years. However, bubbles have continued to occur throughout history, and they will likely continue to occur in the future.

Here are some of the lessons that can be learned from the government’s response to the South Sea Bubble:

- Regulatory changes can help to prevent bubbles: Government regulation can help to prevent bubbles by making it more difficult for people to invest in assets that are overpriced.

- Regulatory changes need to be constantly updated: Bubbles are constantly evolving, so regulatory changes need to be constantly updated to keep up with them.

- Regulatory changes can only do so much: Bubbles are caused by a complex combination of factors, so regulatory changes are only one part of the solution.

By understanding the factors that lead to bubbles and the role that government regulation can play, we can learn how to better prevent and manage bubbles in the future.

Influence of the South Sea Bubble on the development of financial markets and investment practices

The South Sea Bubble had a significant impact on the development of financial markets and investment practices. The bubble burst in 1720, when the share price of the South Sea Company crashed. Many people lost a lot of money, and the British government was forced to step in to bail out the company.

The South Sea Bubble led to a number of changes in the way financial markets and investment practices were regulated. The British government enacted a number of laws designed to prevent similar bubbles from happening in the future. These laws included:

- The Bubble Act of 1720: The Bubble Act prohibited the formation of any new joint-stock companies without a royal charter. This was designed to prevent the formation of companies that were likely to engage in speculative behavior.

- The Bank Act of 1742: The Bank Act limited the amount of money that the Bank of England could lend to the government. This was designed to prevent the government from using easy credit to finance its spending, which could lead to bubbles.

- The Stock Exchange Act of 1801: The Stock Exchange Act established the London Stock Exchange as a regulated market. This was designed to provide investors with more information about the companies they were investing in, which could help to prevent bubbles.

These regulatory changes were successful in preventing similar bubbles from happening in the United Kingdom for a number of years. However, bubbles have continued to occur throughout history, and they will likely continue to occur in the future.

Here are some of the lessons that can be learned from the South Sea Bubble:

- Regulatory changes can help to prevent bubbles: Government regulation can help to prevent bubbles by making it more difficult for people to invest in assets that are overpriced.

- Regulatory changes need to be constantly updated: Bubbles are constantly evolving, so regulatory changes need to be constantly updated to keep up with them.

- Regulatory changes can only do so much: Bubbles are caused by a complex combination of factors, so regulatory changes are only one part of the solution.

By understanding the factors that lead to bubbles and the role that government regulation can play, we can learn how to better prevent and manage bubbles in the future.

In addition to the regulatory changes, the South Sea Bubble also led to a number of changes in investment practices. Investors became more skeptical of new investment opportunities, and they were more likely to do their research before investing. This led to a more rational and less speculative approach to investing.

The South Sea Bubble was a major financial crisis that had a significant impact on the development of financial markets and investment practices. The bubble burst led to a recession, increased unemployment, and social unrest. The South Sea Bubble is a cautionary tale about the dangers of speculative behavior and investor sentiment. By understanding the factors that led to the South Sea Bubble, we can learn how to avoid similar bubbles in the future.

Relevance of the South Sea Bubble to contemporary investment landscape

The South Sea Bubble is a relevant historical event to the contemporary investment landscape for a number of reasons.

First, it demonstrates the dangers of speculative behavior and investor sentiment. During the South Sea Bubble, people were buying shares in the South Sea Company not because they believed in the underlying value of the company, but because they believed that the share price would go up in the future. This speculative behavior led to the bubble bursting and many people losing a lot of money.

Second, the South Sea Bubble shows how government policies can contribute to bubbles. The British government was heavily involved in the South Sea Company, which gave the company a lot of credibility and made it seem like a safe investment. This government support may have encouraged people to buy shares in the company, even if they did not fully understand the risks involved.

Third, the South Sea Bubble demonstrates the importance of regulation in preventing bubbles. The British government enacted a number of regulatory changes after the bubble burst, designed to prevent similar bubbles from happening in the future. These regulatory changes, such as the Bubble Act of 1720, helped to make financial markets more stable and less prone to bubbles.

The contemporary investment landscape is still susceptible to bubbles, and the South Sea Bubble provides valuable lessons for investors. By understanding the factors that led to the South Sea Bubble, investors can better protect themselves from losing money in future bubbles.

Here are some of the key lessons that can be learned from the South Sea Bubble and applied to the contemporary investment landscape:

- Be skeptical of new investment opportunities: When an investment opportunity seems too good to be true, it probably is. Do your research and make sure you understand the risks involved before investing.

- Don’t let emotions cloud your judgment: When you’re investing, it’s important to stay calm and rational. Don’t let fear or greed make you make decisions that you’ll regret later.

- Don’t invest more than you can afford to lose: When you invest, it’s important to only invest money that you can afford to lose. This way, if you do lose money, it won’t have a significant impact on your financial situation.

By following these tips, you can help to protect yourself from losing money in future bubbles.

Psychological and behavioral factors contributing to the South Sea Bubble

There are a number of psychological and behavioral factors that contributed to the South Sea Bubble.

FOMO (Fear of Missing Out): During the South Sea Bubble, many people were afraid of missing out on the opportunity to make a lot of money. This fear led them to buy South Sea Company shares, even if they did not fully understand the risks involved.

Greed: Many people were also motivated by greed during the South Sea Bubble. They saw the share price of the South Sea Company rising, and they wanted to get in on the action. This greed led them to buy shares at increasingly high prices, even though the underlying value of the company was not increasing.

Herd Mentality: People also tend to follow the crowd, especially when it comes to investing. During the South Sea Bubble, many people saw that others were buying South Sea Company shares, and they wanted to do the same. This herd mentality led to even more people buying shares, which drove up the price even further.

Overconfidence: Many people were also overconfident during the South Sea Bubble. They believed that the share price of the South Sea Company would continue to rise, and they were willing to take on more risk than they normally would have. This overconfidence led them to make poor investment decisions.

These are just some of the psychological and behavioral factors that contributed to the South Sea Bubble. By understanding these factors, we can better understand how bubbles form and how to avoid them in the future.

In addition to the psychological and behavioral factors, there were also a number of economic factors that contributed to the South Sea Bubble. These included:

-

Easy access to credit: During the South Sea Bubble, it was relatively easy to borrow money. This made it easier for people to buy South Sea Company shares, even if they did not have the full amount of money upfront.

-

Government support: The British government was heavily involved in the South Sea Company. This gave the company a lot of credibility and made it seem like a safe investment.

-

Economic growth: The British economy was growing rapidly during the South Sea Bubble. This created a sense of optimism and made people more willing to invest in risky assets.

These economic factors created a perfect storm that led to the South Sea Bubble. By understanding the factors that contributed to the bubble, we can better understand how to avoid similar bubbles in the future.

Impact of the South Sea Bubble on public trust and investor confidence

The South Sea Bubble had a significant impact on public trust and investor confidence. The bubble burst in 1720, when the share price of the South Sea Company crashed. Many people lost a lot of money, and the British government was forced to step in to bail out the company.

The South Sea Bubble led to a loss of public trust in financial markets. Many people felt that they had been misled by the South Sea Company, and they were reluctant to invest in the future. This loss of trust led to a decline in investment activity, which had a negative impact on the British economy.

The South Sea Bubble also led to a loss of investor confidence. Many people who had lost money in the bubble were reluctant to invest again. This loss of confidence made it more difficult for companies to raise capital, which had a negative impact on economic growth.

The South Sea Bubble was a major financial crisis that had a significant impact on public trust and investor confidence. The bubble burst led to a loss of trust in financial markets and a loss of investor confidence. These losses had a negative impact on the British economy for many years.

Here are some of the lessons that can be learned from the South Sea Bubble:

- Be skeptical of new investment opportunities: When an investment opportunity seems too good to be true, it probably is. Do your research and make sure you understand the risks involved before investing.

- Don’t let emotions cloud your judgment: When you’re investing, it’s important to stay calm and rational. Don’t let fear or greed make you make decisions that you’ll regret later.

- Don’t invest more than you can afford to lose: When you invest, it’s important to only invest money that you can afford to lose. This way, if you do lose money, it won’t have a significant impact on your financial situation.

By following these tips, you can help to protect yourself from losing money in future bubbles.

The role of information dissemination and communication in the spread of the bubble

The role of information dissemination and communication in the spread of the South Sea Bubble was significant. The company’s promoters used a variety of methods to spread information about the company and its potential profits, including pamphlets, newspapers, and word-of-mouth. This information created a sense of excitement and optimism about the company, which led to increased demand for its shares.

As the share price of the South Sea Company rose, more and more people became interested in investing in the company. This created a self-reinforcing cycle, as the rising share price made the company seem more attractive to investors, which led to even higher demand for its shares.

The role of information dissemination and communication in the spread of the South Sea Bubble is a reminder of the importance of critical thinking and financial literacy. When faced with an investment opportunity that seems too good to be true, it is important to do your research and understand the risks involved.

Here are some of the ways that information dissemination and communication contributed to the spread of the South Sea Bubble:

- Pamphlets: The South Sea Company’s promoters published a number of pamphlets that extolled the virtues of the company and its potential profits. These pamphlets were widely distributed, and they helped to create a sense of excitement and optimism about the company.

- Newspapers: The South Sea Company’s promoters also used newspapers to spread information about the company. They placed favorable articles in newspapers, and they also used newspapers to report on the company’s rising share price. This reporting created a sense of FOMO (Fear of Missing Out), which led to even more people buying shares in the company.

- Word-of-mouth: The South Sea Company’s promoters also used word-of-mouth to spread information about the company. They encouraged their friends, family, and colleagues to invest in the company, and they also spread the word through social gatherings and other social events. This word-of-mouth communication helped to create a sense of momentum behind the company, which led to even more people buying shares.

The South Sea Bubble is a cautionary tale about the dangers of speculation and the importance of critical thinking. When faced with an investment opportunity that seems too good to be true, it is important to do your research and understand the risks involved.

Examination of the financial instruments and trading strategies involved in the bubble

The South Sea Bubble was a financial crisis that occurred in 1720, when the share price of the South Sea Company rose to a high of £1,000 before crashing to £100. The bubble was caused by a number of factors, including speculation, easy access to credit, and government support.

There were a number of financial instruments and trading strategies involved in the South Sea Bubble. Some of the most common instruments included:

- Shares: Shares were the most common financial instrument involved in the South Sea Bubble. Shares represented ownership in the South Sea Company, and they could be bought and sold on the stock market.

- Options: Options gave the holder the right to buy or sell shares at a predetermined price on or before a certain date. Options were often used to speculate on the future price of shares.

- Futures: Futures contracts were agreements to buy or sell a certain amount of shares at a predetermined price on a future date. Futures were often used to hedge against risk or to speculate on the future price of shares.

There were also a number of trading strategies that were used during the South Sea Bubble. Some of the most common strategies included:

- Day trading: Day trading is a trading strategy where investors buy and sell shares on the same day. Day traders often use technical analysis to make trading decisions.